Goal

- Manage key rate duration risk in MBS trading books, and/or MSR portfolios

- Customers can also position for a widening or narrowing in MBS yields vs swaps

Benefits

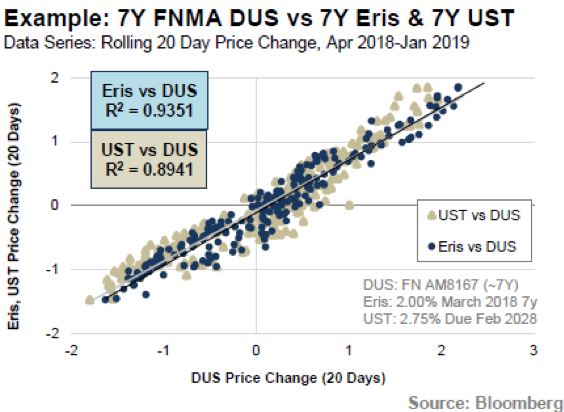

Mitigate Spread Risk - Eris swap futures incorporate LIBOR swap risk, which can be more highly correlated to underlying exposures in MBS and MSR portfolios than Treasury products

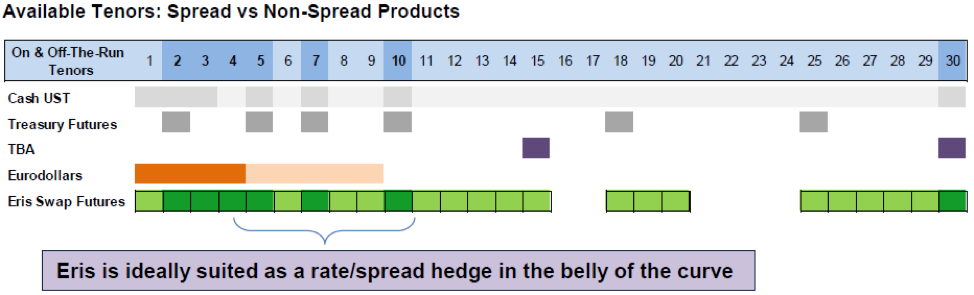

Trade the whole curve with no forced roll / delivery - Eris offers a wide array of available tenors - 2, 3, 4, 5, 7, 10, 12, 15, 20 and 30y underlying maturities with multiple effective dates to choose from

- Unlike other futures or TBAs, Eris positions can be left outstanding to the full underlying maturity, allowing for more flexibility in hedging

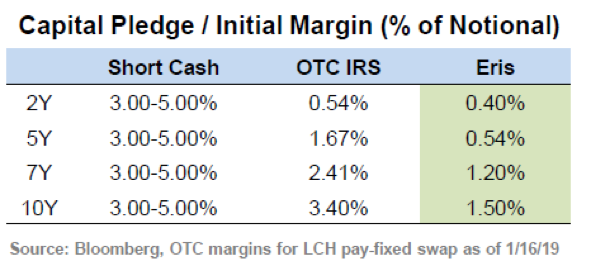

Capital Pledge / Margin Savings - Prime brokers generally assess a capital pledge of 3-5% for cash Treasury shorts, and cleared swaps require initial margins based on a 5-7 day close out period

- Eris margins are 40-60% lower than cleared swaps (based on a 2 day close out period), and in most cases far lower than the capital pledge on Treasury shorts

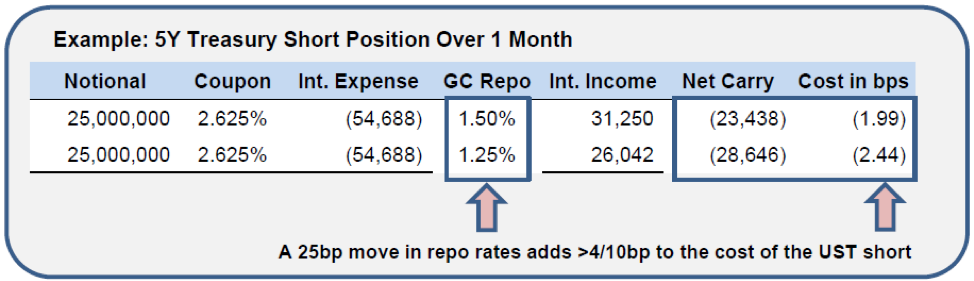

Avoid a potential short squeeze in repo - A cash Treasury short position often creates negative carry between the fixed coupon paid on the underlying bond and the repo rate received

- Because the cash Treasury short position references a specific deliverable bond, hedgers are exposed to potentially significant cost increases should the Treasury “go special†in repo

- Eris futures settle to an orderbook driven curve, with no supply limitations, and therefore cannot be squeezed

Examples

Buy MBS basis by selling 10y Eris, and buying TBA MBS; or hedge an investment in 5y DUS bonds by selling Eris 5y