Daily Cash Flows Example

This interactive graph helps explain how Eris SOFR Swap futures work, by displaying the component daily cash flows over the life of an example position.

The instrument shown is YITU21, a 2-year Eris SOFR contract first listed 15-Dec-2020. It has:

- A fixed rate (coupon) of 0.00%

- An effective date of 15-Sep-2021 (date fixed and floating payments started accruing)

- Annual fixed/floating payment dates (19-Sep-2022 and 19-Sep-2023)

- Matured on the last payment date (19-Sep-2023)

The graph shows the daily cash flows of a 1,000-lot ($100 million notional) short position (pay fixed, receive compound overnight SOFR) entered into on the date it was first available for trading (15-Dec-2020).

The data underlying this graph is available for all Eris SOFR Swap futures in daily, publicly-available files. See below for detailed field definitions and links to source data.

The default view of the graph demonstrates that the daily total return Total Cash Flow (from Settlement) is composed of Eris A (NPV), Eris B (Past Payments) and Eris C (Price Alignment Interest).

- Cash flows for Eris SOFR are equivalent to daily cash flows for interest rate swaps cleared at CME Clearing. Values for the three component cash flows, Eris A (NPV), Eris B (Past Payments) and Eris C (Price Alignment Interest) match values for an equivalent cleared swap. For cleared IRS, these three components are exchanged in a single daily banking transaction (i.e., “net banked”), in an amount equivalent to Total Cash Flow (from Settlement).

- During the forward period (from 15-Dec-2020 listing date to 15-Sep-2021 effective date), virtually all Total Cash Flow is driven by Eris A (NPV); fixed and floating payments (Eris B) haven’t even started to accrue, must less be paid, and Price Alignment Interest (Eris C) is negligible, so the NPV of future payments drives the value of the position.

- On the first payment date (19-Sep-2022), Eris B (Past payments) jumps based on the net payment amount. Importantly, Eris A (NPV) drops similarly, such that the net change Total Cash Flow for 19-Sep-2022 isn’t affected by the payment amount.

- On the final payment date (19-Sep-2023), Eris B (Past payments) jumps again, and, along with Eris C (Price Alignment Interest), comprises the full value (Total Cash Flow) of the position. There are no more future payments, so NPV (A) drops to zero.

- Eris C (Price Alignment Interest), the accumulated daily overnight interest on NPV, never accounts for a significant portion of the Total Cash Flow, but it’s nonetheless important for ensuring Eris SOFR tracks interest rate swap cash flow precisely.

- Note: The typical sign/direction of Eris C is flipped in this graph, to make it easier to visualize that Total Cash Flows are composed of A + B + C. When using CME Group and Eris Innovation data, note that settlement price = 100 + A + B - C.

- An alternative view of this graph illustrates daily cash flows broken down into accounting components, and highlights how Eris SOFR Swap futures embed the same “carry” as a swap with the same terms.

- In this view, we observe that Total Cash Flow (from settlement) is composed of Eris A’ (NPV less Unpaid Accruals), Eris B’ (Past payments plus Unpaid Accruals; “Carry”) and Eris C (Price Alignment Interest).

- Eris B’ (we pronounce it “Bee dash”) tracks what many people call “carry,” the sum of net fixed/floating payments and net fixed/floating accruals (known based on past SOFR fixings, but not yet “paid”).

- In this graph, as one would expect, Eris B’ is always zero prior to the 15-Sep-2021 effective date, since fixed and floating payments don’t accrue during a swap forward period.

- Starting 16-Sep-2021, Eris B’ climbs for the remainder of the position’s life, which makes sense when one considers this position is “paying fixed” at a 0.00% coupon and receiving SOFR in a period where overnight SOFR never went negative, started near zero, crossed 1% in mid-2022 and crossed 5% in early 2023.

- Eris A’ (NPV less Unpaid Accruals) isolates what some people call the “Clean NPV,” the portion of NPV attributable solely to marking-to-market the unknown portions of futures payments.

- As time progresses, Eris B’ gradually becomes a more significant portion of Total Cash Flow, as Eris A’ declines in corresponding amount, hitting zero at the maturity date.

- After the 19-Sep-2022 final payment, the Total Cash Flow is comprised solely of Eris B’ (which itself is now solely comprised of past payments, without any accruals) and Eris C (Price Alignment Interest).

- Please reach out to questions@erisfutures.com to learn more about accounting for Eris SOFR Swap futures. We have a CPA on staff who can provide you with a super cool Excel worksheet called “Eris Ledger Flow” (ELF) to show ledger-level accounting detail.

- Accounting for Eris SOFR swap futures is operationally painless. Whereas third-party systems or software-based valuation engines are necessary to value virtually any OTC financial instrument, Eris SOFR end users have access to data rich settlement files published by Eris and CME Group.

- This relates to the data points presented above [in the foregoing charts], which include but are not limited to swap net present value, accrued interest, cash flow settlements and PAI (accumulating daily interest on the swap NPV, aligning Eris with swaps where interest is earned on the settled variation margin, or collateral posted to secure the swap NPV.)

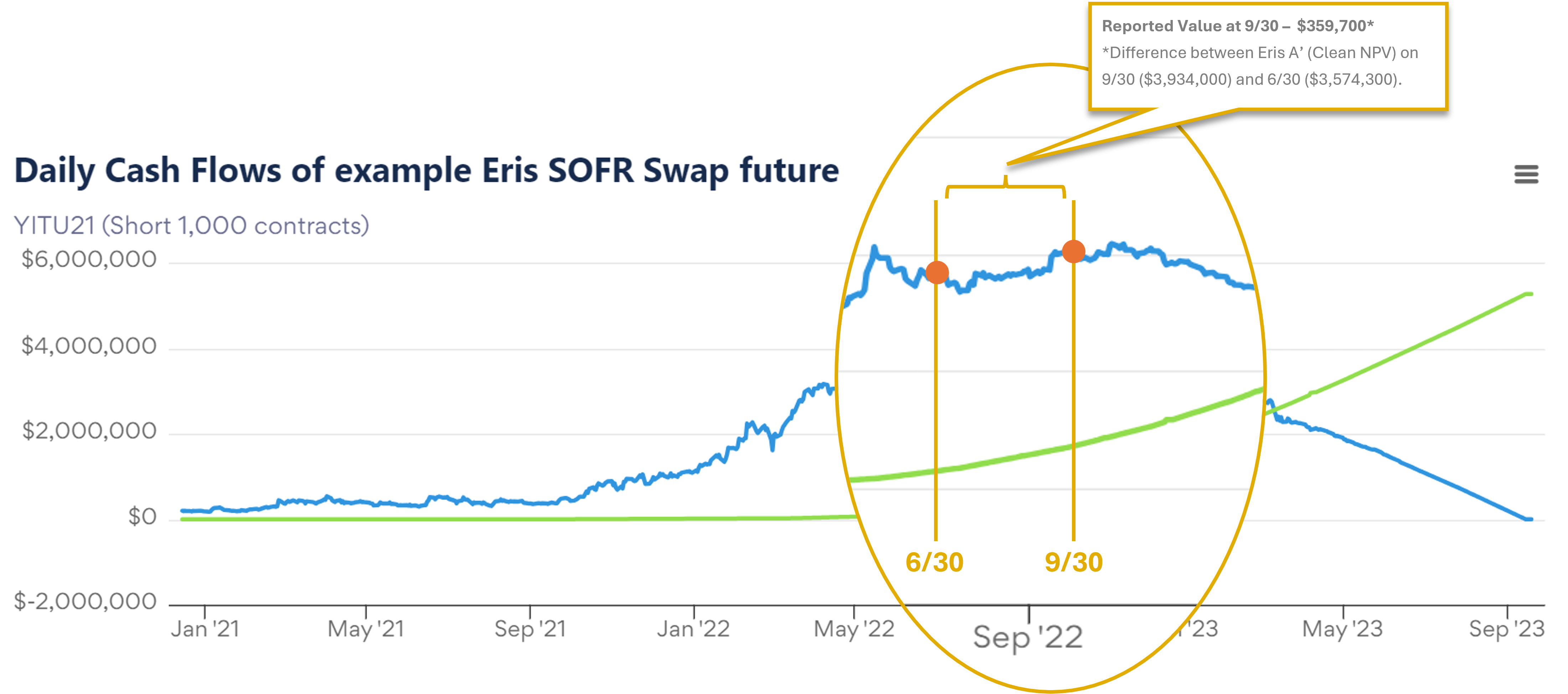

- As an exchange-traded derivative, Eris SOFR is an index-based financial instrument. This means that its mark-to-market and income/expense amounts are derived from the point of entry relative to a given reporting date. This is best illustrated by the chart image above and the example as follows:

- Assume for a moment that Entity A sells the YITU21 swap future for 1,000 contracts on 6/30 and is now recording the net present value of the swap in its financial statements.

- On 6/30, the index net present value of the contract published by the exchange is $3,574,300. For accounting purposes, the net present value reported in Entity A’s financial statements at end of day 6/30 would be zero ($3,574,300 [Reporting 6/30] - $3,574,300 [Index 6/30] = $0).

- On 9/30, the index net present value of the contract published by the exchange is $3,934,000. For accounting purposes, the net present value reported in Entity A’s financial statements at end of day 9/30 would be $359,700 ($3,934,000 [Reporting 9/30] - $3,574,300 [Index 6/30] = $359,700).

- Please reach out to questions@erisfutures.com to learn more about accounting for Eris SOFR Swap futures. We have a CPA on staff who can provide you with a super cool Excel worksheet called “Eris Ledger Flow” (ELF) to show ledger-level accounting detail.

| Key Terms of Swap Future | Value |

| Ticker | YITU21 |

| Coupon | 0.00% |

| Listing Date (First Trade Date) | 12/15/2020 |

| Effective Date | 9/15/2021 |

| First Payment Date | 9/19/2022 |

| Second Payment Date | 9/19/2023 |

| Cash Flow Alignment Date | 9/15/2023 |

| Last Trade Date | 9/15/2023 |

| Maturity Date | 9/19/2023 |

| Label | Definition | Field Label in Eris Data Files |

|---|---|---|

| Eris A (NPV) | An Eris Contract Price is constructed as 100 + A + B - C. This value is the Eris A value, and is equivalent to the SOFR discounted present value (NPV) of all future fixed and forecasted floating cash flows, assuming a $100.00 notional swap. | NPV (A) |

| Eris B (Past Payments) | This value records the Eris B value, and is equal to the cumulative fixed and floating coupon cash flow payments that take place during the life of the underlying swap. This value is Zero until the date of the first fixed or floating coupon payment, at which point, cash flows move from Swap NPV (the Eris A value) into PastFxdFltPmts (Eris B value). At the end of the life of the swap, Eris A will be Zero, and all cash flows during the life of the swap will be recorded in Eris B. | PastFxdFltPmts (B) |

| Eris C (Price Alignment Interest) | This value records the Eris C value, which is the accumulating PAI (price

alignment interest). Eris PAI is calculated as accumulating daily SOFR interest

on the previous day's Swap NPV (with the Swap NPV adjusted for cash flows scheduled for the Evaluation Date). Eris PAI mirrors the price alignment amount if the swap were a CME cleared swap.

GRAPH DISPLAY NOTE: To aid visualization, the Eris C values on this graph have been reversed from positive to negative. This makes it easier to verify, for example, that Total Cash Flow (Settlement) on the final day is the sum of Eris B and Eris C. |

Eris PAI (C) |

| Unpaid Accruals | This value records fixed coupon accruals, minus floating coupon accruals since the start date of the current fixed and floating coupon calculation periods. As this value has not yet been paid, it is effectively a component of Swap NPV (Eris A). This amount may be subtracted from Swap NPV (Eris A) to determine a Clean Swap NPV. Equally, this amount may be added to PastFxdFltPmts (Eris B) to determine the total value of the swap that is attributable to coupons and accruals from the swap Effective Date to the current Evaluation Date. This value may be useful for accounting and tax purposes. | NetUnpaidFixedFloatingAccrual |

| Eris A’ (NPV less Unpaid Accruals) | This value records the Swap NPV (Eris A) less the amount of fixed and floating coupons that have accrued since the start date of the current fixed and floating coupon calculation periods. In doing so, this value is akin to a clean Swap NPV, that portion of the swap attributable to the future. This value removes past accruals from Swap NPV (Eris A), leaving only future value, and is useful for accounting and tax purposes. | NPV(A)lessNetUnpaidFixedFloatingAccrual |

| Eris B’ (Past payments plus Unpaid Accruals; “Carry”) | This value records the accumulation of past fixed and floating payments that have taken place, PLUS the fixed and floating payments that have accrued since the start date of the current fixed and floating coupon calculation periods. In doing so, this value records that portion of the swap's fixed and floating coupon cash flows and unpaid accruals that may be deemed to have taken place. This amount is useful for accounting and tax purposes. | PastFxdFltPmts(B)plusNetUnpaidFixedFloatingAccrual |