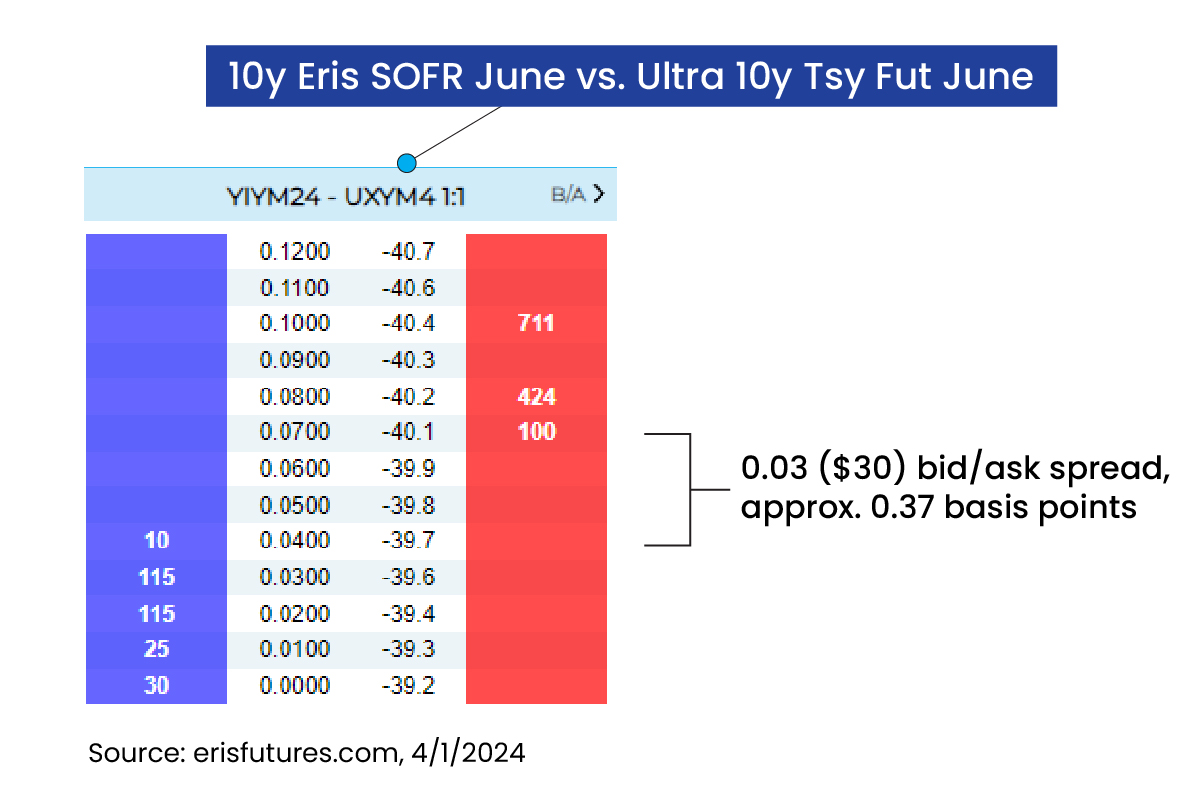

- Bid/ask spreads of Eris/Treasury futures Inter-Commodity Spreads (ICS) continued to tighten in March, with 10-year Eris SOFR vs. CME Ultra 10-year Treasury Futures 0.5 bp or tighter 42% of regular trading hours

- These ICS allow for trading swap spreads in futures form, with electronic execution in lots sizes of $100K notional

- To view market data, request the Eris ICS Bloomberg Launchpad, or visit erisfutures.com/live

Date