- CME launched Eris/Treasury Inter-Commodity Spreads (ICS) on Nov 13, allowing guaranteed order book trading of spreads between between Eris SOFR Swap futures and CME Treasury futures

- These ICS markets offer electronic execution of futures/futures swap spreads to dealers and other traditional swap users in:

- 5y Eris SOFR vs FV

- 7y Eris SOFR vs. TY

- 10y Eris SOFR vs. UXY

- Nascent liquidity in the ICS markets has already made an impact, with implied prices tightening Eris SOFR outright markets and spurring additional trading activity

- Want to see these markets in Bloomberg? Reply to this email to request the Bloomberg Launchpad for Eris ICS, and we’ll share it with you

![]()

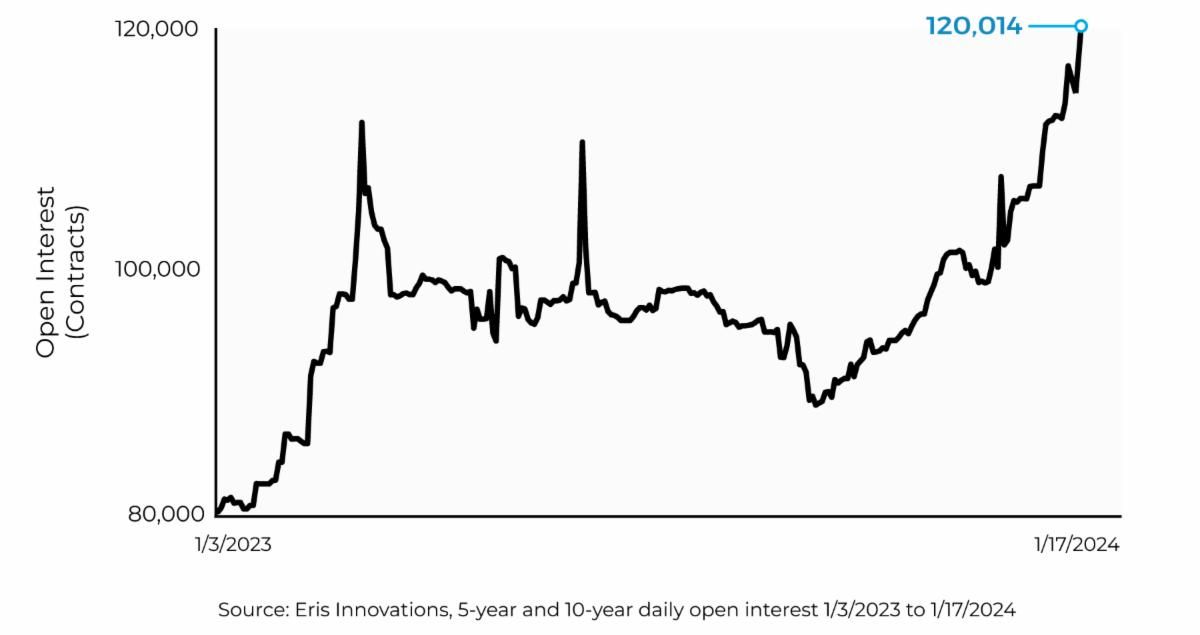

Open interest +48%for 5y & 10y in the past year

- 5-year and 10-year Eris SOFR open interest stands at 120,014 contracts as of Jan 17, 48% higher than combined Libor/SOFR OI at the start of 2023

- Growth reflects an increased number of swap users taking advantage of much-improved liquidity, fueled by CME’s February introduction of swaps/futures portfolio margining

- 5-year Eris SOFR saw the strongest OI growth, increasing by more than 27,000 contracts during the period

Loading...

Date