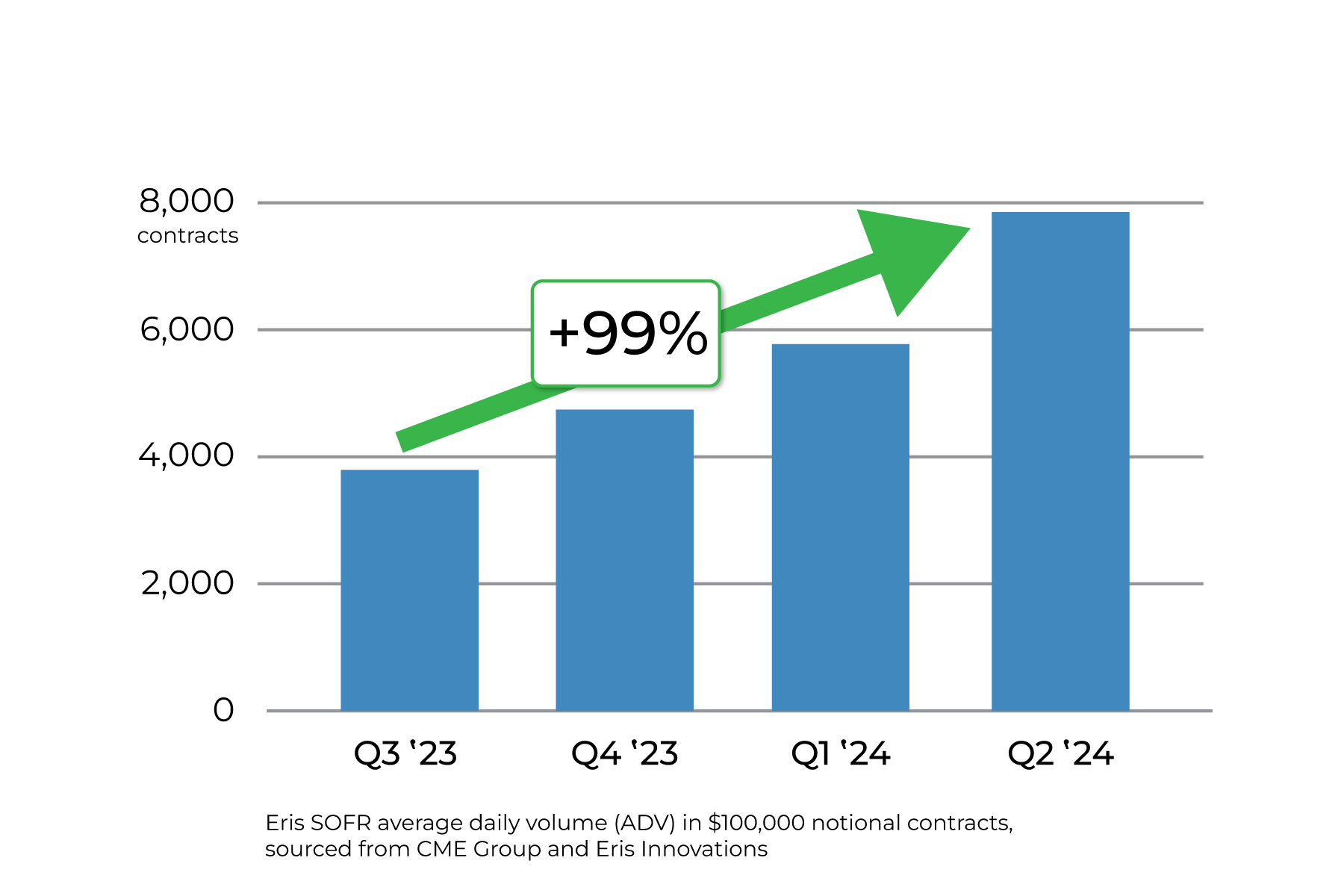

Eris SOFR: Record June caps record volume quarter

- Eris SOFR average daily volume hit 17,122 contracts in June, a new monthly record

- Q2 volume set a new quarterly record, the third consecutive quarter of growth since the June 2023 migration from Libor to SOFR

- The 5-year and 10-year tenors are driving volume growth, spurred by new hedging activity from regional banks and mortgage companies

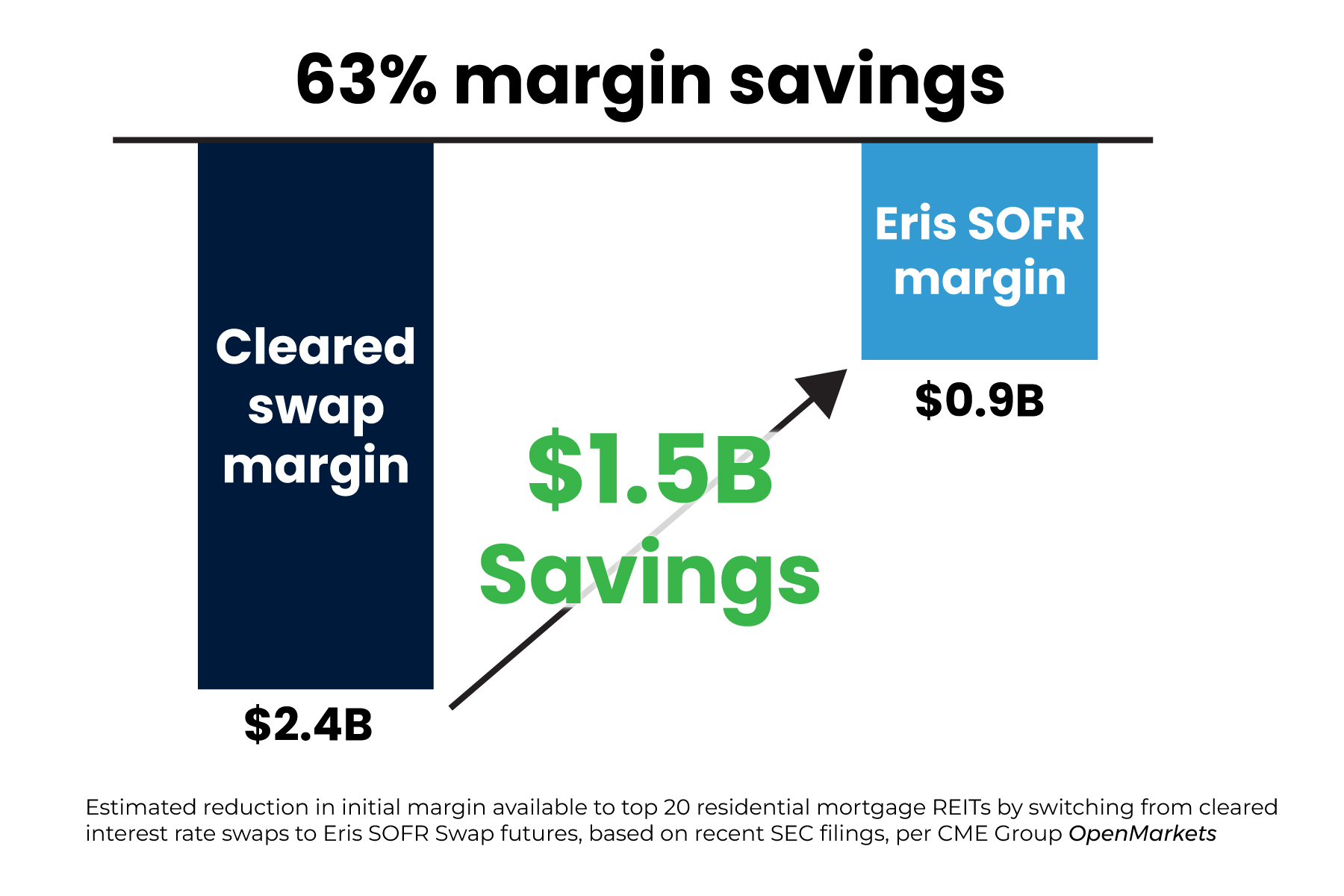

CME Group: REITs are Switching to Swap Futures to Free Up Cash

- CME Group recently featured Eris SOFR in an OpenMarkets blog entry on “the potential for a structural shift in the REIT industry in hedging efficiency"

- The article quotes Minnesota-based REIT Two Harbors regarding their recent public disclosure of using Eris SOFR for hedging: “We’re always looking for ways to manage capital more efficiently and hedging with swap futures combines the risk exposure of SOFR swaps with the margin efficiency of futures.”

- Based on public SEC filings and using the CME CORE margin calculator, the authors conclude “top REITs could save $1.5 billion in posted margin by switching to Eris SOFR swap futures”

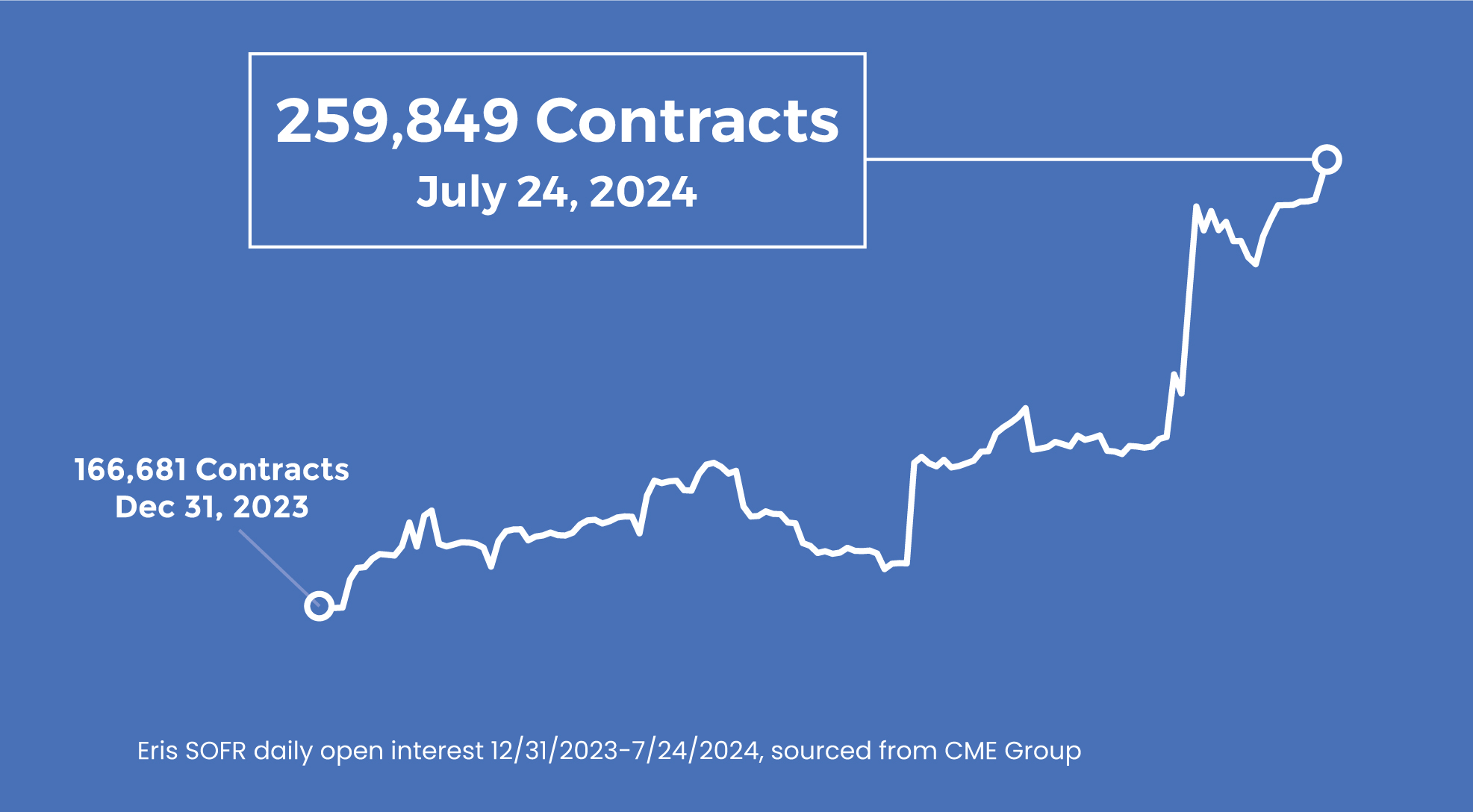

Open interest up 50% year to date

- Eris SOFR open interest is 259,849 contracts as of July 24, up more than 50% this year and up 25% since crossing 200K less than two months ago

- Nearly all of the growth is in front-month open interest, which currently stands at 142,200 contracts, more than doubling since April 1

- Again, 5-year and 10-year tenors lead the way, with each now having surpassed 50,000 contracts in open interest

![]()

Date