Driven by capital efficiency improvements from CME’s late-Feb introduction of Portfolio Margining, Eris SOFR swap futures order book liquidity has grown tighter and deeper

10-year Eris SOFR has benefited most, with a 5X increase in quoted size and more than 50% reduction in average bid/ask spread since January

10y open interest increased to 19,776 contracts, recently setting trading volume records for roll and non-roll months

Click Here to Read More

Funds to fuel growth as CME Group portfolio margining unlocks swap dealer liquidity for Eris SOFR Swap Futures

March 8, 2023 – CHICAGO – Eris Innovations, an intellectual property licensing company that partners with global financial exchanges to develop futures products, today announced the closing of a $7.2 million strategic investment round. The announcement follows the February 27 addition of Eris SOFR Swap Futures (Eris SOFR) as products eligible for portfolio margining with interest rate swaps cleared by CME Group.

Each of the investors is affiliated with companies that trade Eris SOFR, including DV Trading, DRW, Virtu Financial, ARB Trading Group and Arclight Securities. As part of the deal, Jared Vegosen, co-founder of DV Trading, has joined the Eris Innovations board of directors.

“The recent inclusion of Eris SOFR in swaps portfolio margining is a defining moment for the Eris business,” said Vegosen. “DV Trading has been an active market maker in Eris SOFR since its launch, and we plan to grow our presence to provide end users with the benefits of tighter markets.”

Portfolio Margining reduces by 85-95% the cost of holding Eris SOFR positions against offsetting interest rate swaps cleared by CME Group. These savings help swap dealers and other market makers satisfy demand from market participants, especially leveraged investors taking advantage of Eris SOFR’s efficient futures margin levels to decrease their cost of hedging. A list of swap dealers offering block markets in Eris SOFR is available at erisfutures.com/blockmm.

“The next chapter of the Eris growth story starts this week, as swap dealers and Eris partner firms leverage portfolio margining to ramp up their activity in Eris SOFR,” said Michael Riddle, CEO of Eris Innovations. “We appreciate the vote of confidence from investors who share our vision of Eris SOFR as a liquid benchmark futures contract, and welcome Jared to the board.”

Eris SOFR Swap Futures are cash-settled futures contracts listed at CME Group that replicate the risk exposure of a standard SOFR overnight index swap, with tenors from 1-30 years. End users carrying directional Eris SOFR positions can expect to save 50-70% in initial margin compared with an equivalently-structured cleared interest rate swap. Eris SOFR open interest has increased more than 150% since June 1.

###

About Eris Innovations

View live markets for Eris SOFR at erisfutures.com. Eris Innovations is an intellectual property licensing company that partners with global financial exchanges to develop futures products based on its patented product design, the Eris Methodology. Trademarks of Eris Innovations and/or its affiliates include Eris, Eris Innovations, Eris SOFR and Eris Methodology. For more information, visit erisfutures.com or follow us on LinkedIn.

Media Contacts:

Michael Riddle, CEO

michael.riddle@erisfutures.com

Geoffrey Sharp, Managing Director,

Head of Product Development & Sales

geoffrey.sharp@erisfutures.com

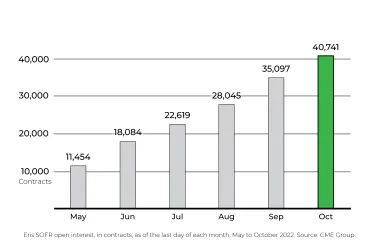

Eris SOFR Swap Futures open interest stands at 40,741 contracts as of October 31, setting a daily recordOctober was a record month for block trades in Eris SOFR, with 33,962 contracts (nearly $3.4 billion notional)3y Eris SOFR OI is 13,387 contracts, having grown more than 10X since MayClick Here to Read More

Eris SOFR open interest hit a new record of 35,034 contracts on Tuesday, September 6, just ahead of the quarterly roll commencing September 12Open interest has increased more than 3X since May 31, driven in large part by block trades migrating Eris Libor positions to Eris SOFRShort-end growth has been particularly strong, spurred in part by end users hedging recent renewals of credit facilities, now indexed to SOFR Click Here to Read More

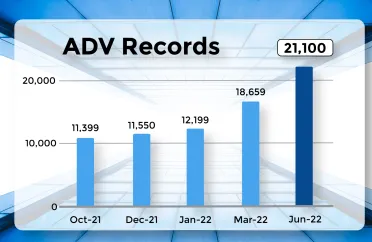

CME Eris Swap Futures set a new record in June with 21,100 contracts average daily volume (ADV)This mark surpasses the previous record of 18,659 ADV in March2-year Eris Libor (LIT) saw the largest share of this daily volume, as participants hedged recent volatility at the short endJune saw multiple end users switch to Eris SOFR and the first trades in CME's new Eris BSBY Swap FuturesClick Here to Read More

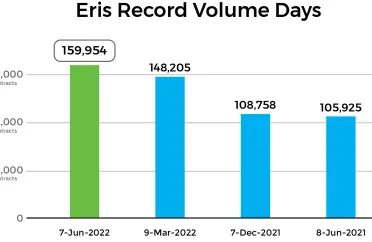

CME Eris Swap Futures volume hit 159,924 contracts on Tuesday, June 7, surpassing the previous record of 148,205 set on March 10Quarterly rolls in 2y Eris Libor (LIT) were a primary driver, fueled by recent record front-month open interest from increased hedging by end usersVolume included block trades rolling to Eris SOFR Sep from Eris Libor June contracts across multiple tenors, including 2y, 3y, 4y and 5yClick Here to Read More!

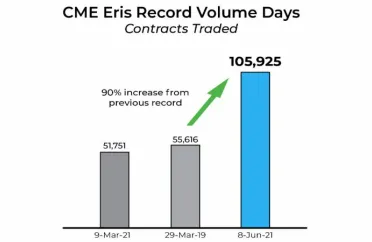

CME Eris Swap Futures traded 105,925 contracts on June 8, breaking the 100,000-contract ($10 billion notional) threshold for the first time, and setting a daily volume recordFront-month open interest has more than tripled since early September, fueling June roll activity that drove volume in Libor-based Eris Swap Futures to 96,225 contracts, surpassing the previous record of 55,616 from March 29, 2019Eris SOFR Swap Futures added 9,700 contracts traded, all in the 1-3 year sector where Eris SOFR accounted for 15% of SOFR swap/swap futures volume in May“Breaking the 100,000-contract threshold yesterday shows the liquidity CME’s Eris Swap Futures bring to market participants soon to transition from Libor to SOFR and credit-sensitive rates,” said Eris Innovations’ CEO Michael Riddle. “Eris SOFR already plays a meaningful role in the nascent SOFR swap market, and we expect Eris SOFR volume to grow in the next two quarters as more dealers, hedge funds and other end users onboard to trade.”Click Here to Read More

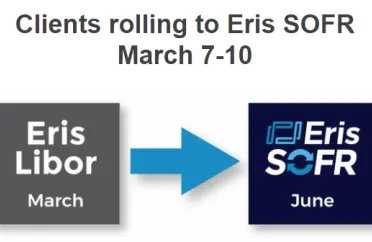

With March 7-10 marking the first Eris quarterly roll following year-end regulatory guidance limiting Libor usage, market participants are poised to migrate to Eris SOFR as they roll from March to June contracts In February, Eris SOFR average daily volume is up nearly 100% compared to Q4 (MTD through February 11) With more than 109,000 contracts of open interest, Eris Libor March positions are expected to roll to Eris SOFR predominantly via block trading, which allows negotiation of two-legged spread trades without execution risk (pursuant to exchange rules) Off-the-run Eris Libor positions will remain tradable until June 2023, then convert in Eris SOFR Swap Futures, according to the CME Conversion Proposal for Eris Libor Products Click Here to read more!

Eris Swap Futures set a new daily record of 108,758 contracts traded on Tuesday, December 7 Coming just ahead of the year-end deadlines for Libor usage, the record surpasses the previous record of 105,925 set June 8As of December 14, total Eris open interest stands at 409,805, an increase of 94% year-to-dateClick Here to Read More