Bloomberg Launchpad

Eris maintains worksheet-based market monitors on Bloomberg for participants to view live Eris SOFR markets in familiar terms of price, yield and DV01 risk, etc. If you want to skip the launchpad view and just look up the individual tickers yourself, you can view the Eris SOFR Bloomberg tickers here.

To receive access to these Bloomberg launchpad monitors:

- Click the blue button above to generate an email request to questions@erisfutures.com

- Include your first name, last name and company as they appear on the terminal

- Once permissioned, navigate to W<GO> on the terminal, and locate the three Eris SOFR worksheets in the “Eris Launchpad” Communities folder

- Consider saving the worksheets to your launchpad desktop using the LLP <GO> function

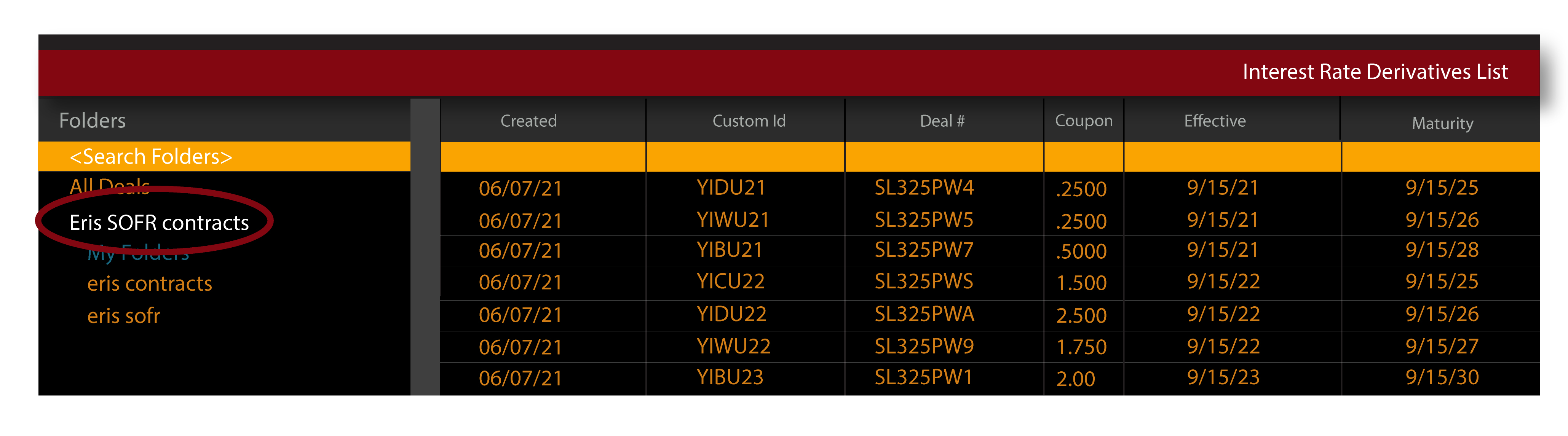

- Note that these worksheets also require Eris to permission users with certain Bloomberg SWPM swap IDs, to support functionality like DV01 and PV01. These may be found in your interest rate deal list using IRDL<GO>.

The 3 Eris SOFR worksheets are:

- Eris SOFR Swap futures: Outright prices for individual contracts

- Eris/Treasury Swap Spreads (ETSS): Listed spreads of Eris SOFR vs UST futures (CME Globex inter-commodity spreads)

- Eris/Eris Curve Spreads: Listed curve spreads of Eris SOFR vs. Eris SOFR (CME Globex inter-commodity spreads)

Eris maintains these worksheets, adding new contracts and calendar spreads when necessary. If you would like these windows enhanced, please let us know the desired functionality, by sending an email to questions@erisfutures.com.

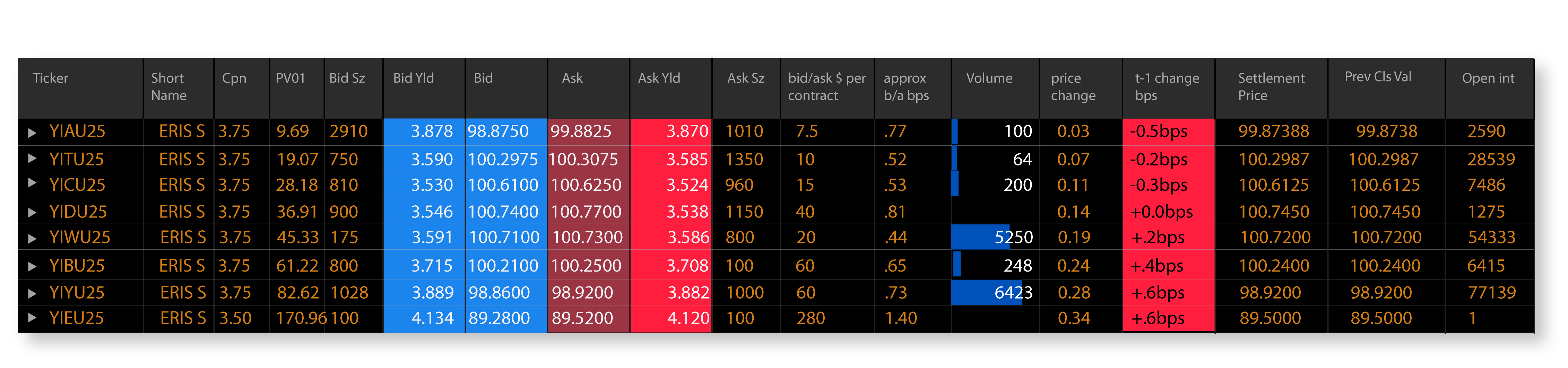

Eris SOFR Swap Futures worksheet

Column fields include: 1-30Y Eris SOFR contract codes, descriptions, coupons, SWPM IDs, contract PV01s & DV01s, bid/ask sizes & yields & prices, bid/asks in $ & basis points, price changes on day, yield changes on day, volumes, total DV01s, latest and previous settle prices, and open interest by contract.

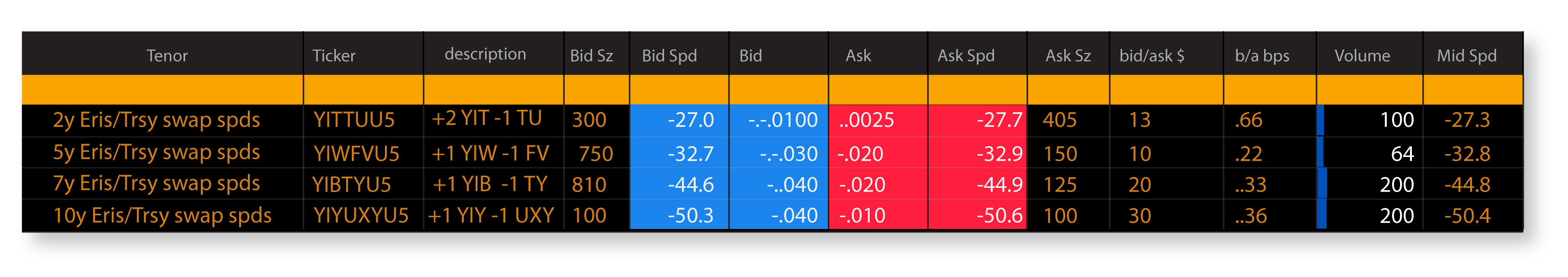

Eris/Treasury Swap Spread (ETSS)

Column fields include: 2, 5, 7 & 10Y ETSS codes, descriptions, leg ratios, leg DV01s, Treasury tail %s, net DV01s, number of contracts for $100k of DV01, bid/ask sizes & yield spreads & prices, bid/ask in $ & basis points, yield spread mid & change on day.

ETSS orders automatically imply into the order books of outright Eris SOFR and UST futures; through the combination of a native spread order and a native order in either Eris SOFR or UST futures. Additionally, the combination of a native Eris SOFR order and a native UST futures order will imply into the Eris/Treasury Swap Spread order book.

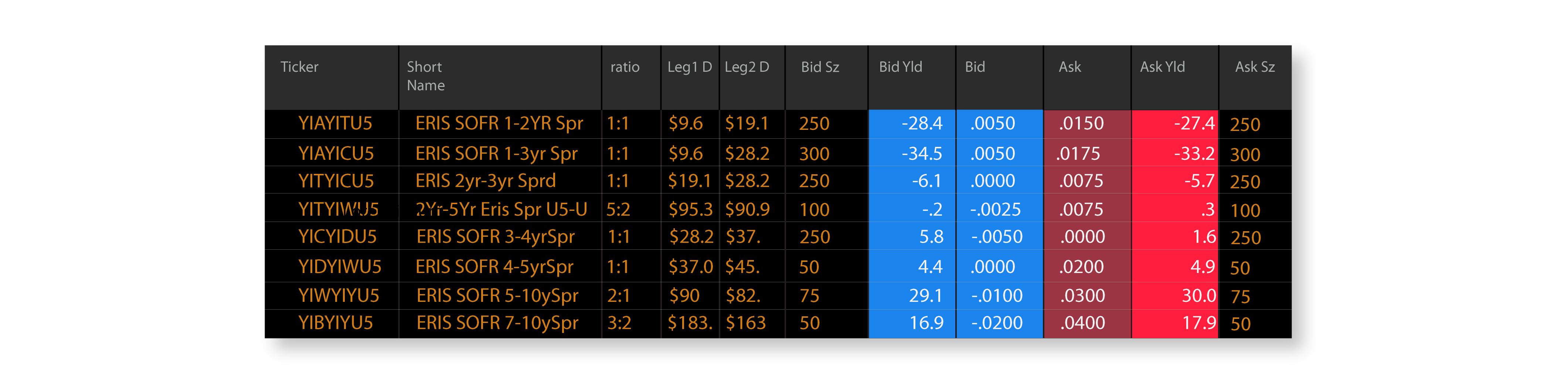

Eris/Eris Curve Spreads

Column fields include: ICS codes, descriptions, leg ratios, leg DV01s, bid/ask sizes & yield spreads & prices.

Eris/Eris orders automatically imply into the order books of the components of the spread, and component prices automatically imply into the spread order book based on component prices.

Viewing Eris SOFR SWPM IDs

Enter IRDL<GO> into a Bloomberg terminal window and open the “Eris SOFR contracts” folder shared with you. Configure your view with >Actions>Manage Views to see the columns displayed below.