Par Rate / Yield Calculations

Par Rate / Yield Calculations for Eris SOFR Swap futures

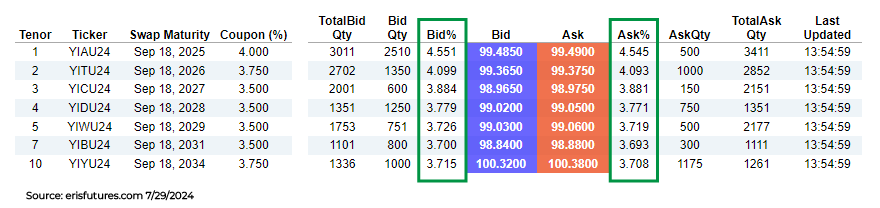

- This page explains how Eris Innovations calculates Par Rate Equivalent (Yield) data, as shown on the home page (Bid%/Ask%), Live Markets (Bid%/Ask%), Contract Lookup (Par Rate), and Trade Log (Par Rate Equvlnt [%]).

- The Par Rate Equivalent (Yield) converts futures price into a basis points value by taking the Swap NPV (implied by the futures price), dividing it by the PV01, then subtracting the result from the Fixed Coupon (see below for details).

- This formula works for on-the-run contracts (prior to the effective date) and for off-the-run contracts (past the effective date), without modification.

- Importantly, for contracts past their effective date, this formula calculates the par rate of a spot-starting swap with remaining cash flows equal to the Eris SOFR contract, with the next fixed and floating payments treated as a short front stub.

- Use the Yield Calculator to determine the Par Rate Equivalent yield for any given futures price or swap NPV.

Formula:

Par Swap Rate = Coupon – ((Price – 100 – “PastFxdFltPmts [B]” + “ErisPAI [C]” – “NetUnpaidFixedFloatingAccrual” ) * 10) / CleanPV01

Data Definitions

| Field | Description | Source(s) | Frequency of Change | Example (YIDM24 trade at 99.2200 on 11-Jul-2024) |

| Par Swap Rate | Par Rate Equivalent (%) | Output of calculation above | Tick-by-tick | 3.953 |

| Coupon | Contract fixed rate (%) | CME S&V; CME DataMine; Eris FTP; Bloomberg | Static per contract (rare exceptions) | 3.75 |

| Price | Futures price format of bid/ask/trade price being converted to Par Rate Equivalent | Market data | Tick-by-tick | 99.2000 |

| PastFxdFltPmts [B] | An Eris Contract Price is constructed as 100 + A + B - C. This value records the Eris B value, and is equal to the cumulative fixed and floating coupon cash flow payments that take place during the life of the underlying swap. This value is Zero until the date of the first fixed or floating coupon payment, at which point, cash flows move from Swap NPV (the Eris A value) into PastFxdFltPmts (Eris B value). At the end of the life of the swap, Eris A will be Zero, and all cash flows during the life of the swap will be recorded in Eris B. | CME S&V; CME DataMine; Eris FTP; Bloomberg | Once per year, on payment date | 0.0000 |

| ErisPAI [C] | An Eris Contract Price is constructed as 100 + A + B - C. This value records the Eris C value, which is the accumulating PAI (price alignment interest). Eris PAI is calculated as accumulating daily SOFR interest on the previous day's Swap NPV (with the Swap NPV adjusted for cash flows scheduled for the Evaluation Date). Eris PAI mirrors the price alignment amount if the swap were a CME cleared swap. | CME S&V; CME DataMine; Eris FTP; Bloomberg | Twice daily | -0.025874312 |

| NetUnpaidFixedFloatingAccrual | This value records fixed coupon accruals, minus floating coupon accruals since the start date of the current fixed and floating coupon calculation periods. As this value has not yet been paid, it is effectively a component of Swap NPV (Eris A). This amount may be subtracted from Swap NPV (Eris A) to determine a Clean Swap NPV. Equally, this amount may be added to PastFxdPmts (Eris B) to determine the total value of the swap that is attributable to coupons and accruals from the swap Effective Date to the current Evaluation Date. This value may be useful for accounting and tax purposes. | CME S&V; CME DataMine; Eris FTP; Bloomberg | Daily (but only after effective date) | -0.092605522 |

| CleanPV01 | $ price change for a 1bp (0.01%) change in the Coupon of the contract, where the swap starting date is set as the later of i) the contract Effective Date, or ii) the current Evaluation Date with short front stubs. | CME S&V; CME DataMine; Eris FTP; Bloomberg; Trader model | At user's discretion; many choose to update daily | 36.18 |

Source Definitions

- Eris FTP: Eris allows free download of multiple-times-per-day contract data. Details here.

- CME MDP S&V: CME Market Data Platform Settlements & Valuations, channel 251. Details here.

- CME DataMine: CME DataMine allows free download of twice daily files of “Eris B&C Data.” Details here.

- Bloomberg: Bloomberg carries critical Eris SOFR reference data. Details here.

- Trader model: Relevant to PV01 data, which is available from CME Group, Eris Innovations and Bloomberg sources, but traders and firms often prefer to source it from their own models.

Par Rate / Yield Calculations for Eris/Treasury Swap Spreads

Par Rate (in basis points) of any ETSS_Price =

((Coupon – ((UST_Last_Price + Eris_Settlement_Price_[T-1] – UST_Settlement_Price_[T-1]+

ETSS_Price – 100 – “PastFxdFltPmts [B]” + “ErisPAI [C]” – “NetUnpaidFixedFloatingAccrual” ) * 10) / CleanPV01) – UST_Last_%) * 100

where

| Field | Description | Source(s) | Frequency of Change | Example (YIYUXYU4 on 8/29/2024) |

| Par Swap Rate (in basis points) | Par Rate Equivalent (%) | Output of calculation above | Tick-by-tick | -46.7 |

| ETSS_Price | Futures price of the Eris/Treasury Swap Spread (e.g., bid, ask, mid, trade) | CME Globex market data (Bloomberg, Refinitiv & others) | Tick-by-tick | 0.06 |

| UST_Last_Price | Last Traded Price of UST Future | CME Globex market data (Bloomberg, Refinitiv & others) | Tick-by-tick | 113.296875 |

| Eris_Settlement_Price_[T-1] | Settlement price from the previous trading day of the Eris SOFR Swap future | CME Globex market data (Bloomberg, Refinitiv & others); CME DataMine; Eris FTP | Daily | 103.17 |

| UST_Settlement_Price_[T-1] | Settlement price from the previous trading day of the US Treasury future | CME Globex market data (Bloomberg, Refinitiv & others) | Daily | 113.3125 |

| UST_Last_% | Most recent forward yield of Cheapest to Deliver (CTD) of the UST Future | CME Globex market data (Bloomberg, Refinitiv & others) | Tick-by-tick | 3.864 |

| Coupon | Contract fixed rate (%) | CME S&V; CME DataMine; Eris FTP; Bloomberg | Static per contract (rare exceptions) | 3.75 |

| PastFxdFltPmts [B] | An Eris Contract Price is constructed as 100 + A + B - C. This value records the Eris B value, and is equal to the cumulative fixed and floating coupon cash flow payments that take place during the life of the underlying swap. This value is Zero until the date of the first fixed or floating coupon payment, at which point, cash flows move from Swap NPV (the Eris A value) into PastFxdFltPmts (Eris B value). | CME S&V; CME DataMine; Eris FTP; Bloomberg | Once per year, on payment date | 0.0000 |

| ErisPAI [C] | An Eris Contract Price is constructed as 100 + A + B - C. This value records the Eris C value, which is the accumulating PAI (price alignment interest). Eris PAI is calculated as accumulating daily SOFR interest on the previous day's Swap NPV. | CME S&V; CME DataMine; Eris FTP; Bloomberg | Twice daily | -0.016833399 |

| NetUnpaidFixedFloatingAccrual | This value records fixed coupon accruals, minus floating coupon accruals since the start date of the current fixed and floating coupon calculation periods. As this value has not yet been paid, it is a component of Swap NPV. | CME S&V; CME DataMine; Eris FTP; Bloomberg | Daily (but only after effective date) | 0.0000 |

| CleanPV01 | $ price change for a 1bp (0.01%) change in the Coupon of the contract, where the swap starting date is set as the later of the contract Effective Date or the current Evaluation Date. | CME S&V; CME DataMine; Eris FTP; Bloomberg; Trader model | At user’s discretion; many choose to update daily | 84.31 |